The use of standard cost together with item charge will be directly posted to the variance accounts

No historical records exist for standard costs.

The Standard Cost Worksheet does NOT support standard cost per SKU.

Inventory Setup -> “Automatic Cost Adjustment” = Never. The system will never adjust costs automatically even production order is finished. Batch process will be required to run manually.

Inventory Setup -> “Automatic Cost Adjustment” <> Never (any other value). When Production Order is finished then Cost Adjustment is completed for Production Order automatically.

It is included in Item Cost and posted to Direct Cost Applied account as part of Item output posting. It is not separating posted.

Item Card -> Overhead Rate or Indirect Cost % are used for Manufacturing Overhead. It is recommended to use Capacity Cost and Work Centre -> Indirect Cost % and Overhead Rate in place of Item Card setup. Please decide whether we should keep it in a document or not.

Subcontracting Cost requires Routing No. configuration change. So, it is explained separately.

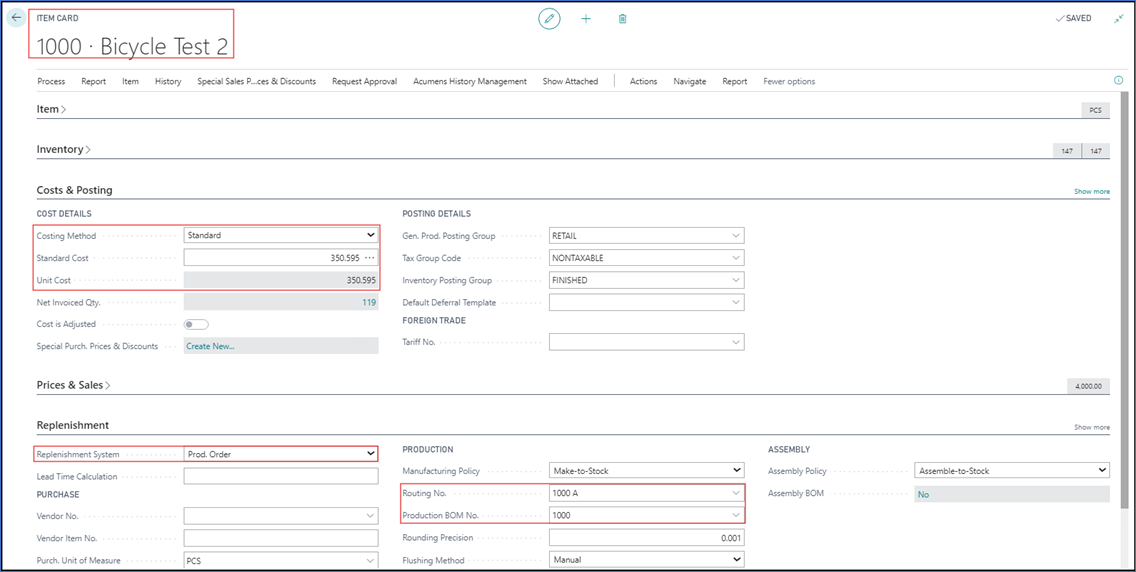

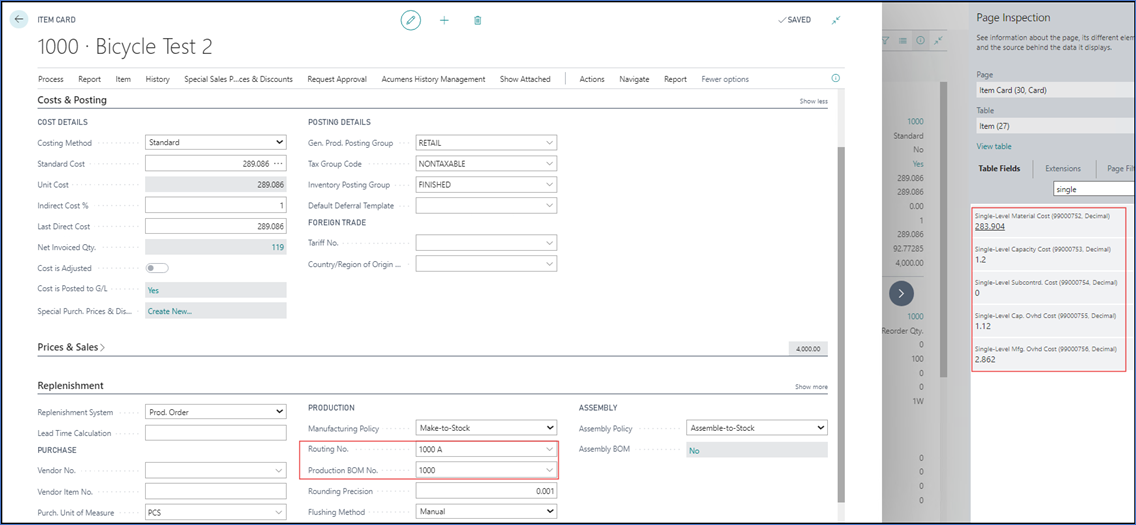

1.1 Item Setup for Manufacturing

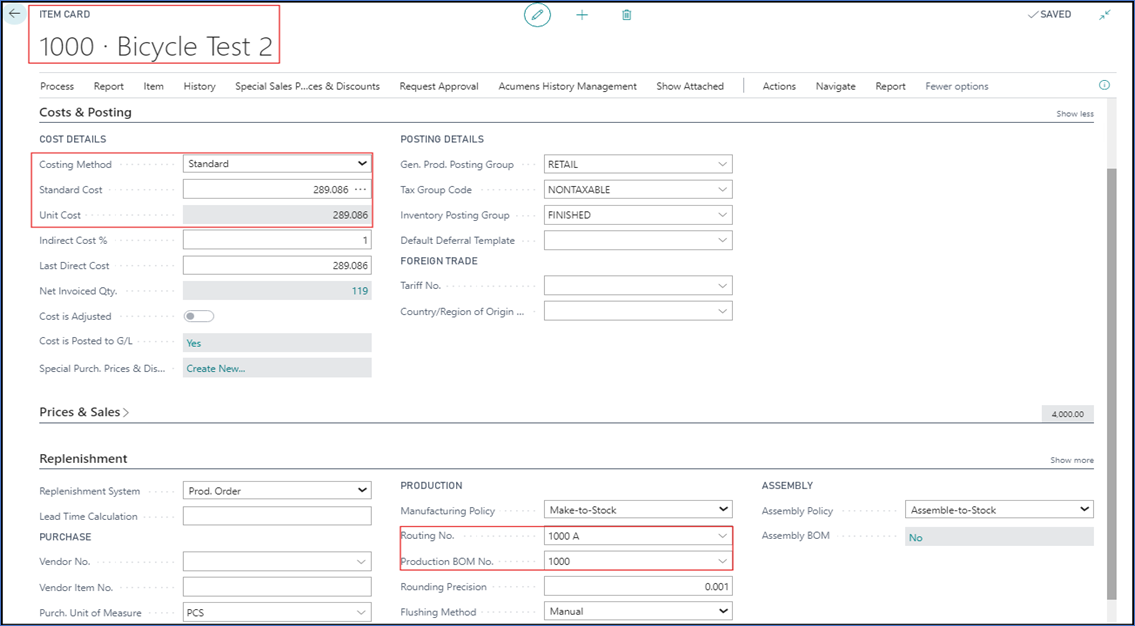

The Item is produced and consists of a BOM and a Routing. Item -> Costing Method is Standard.

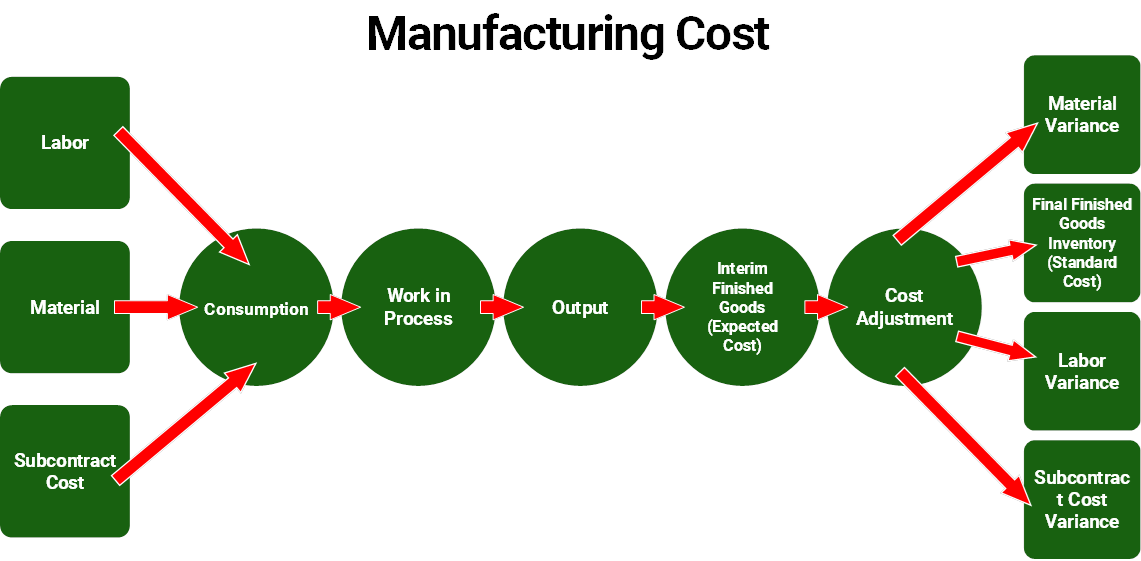

The following key cost elements make up the total direct cost of a finished processed item:

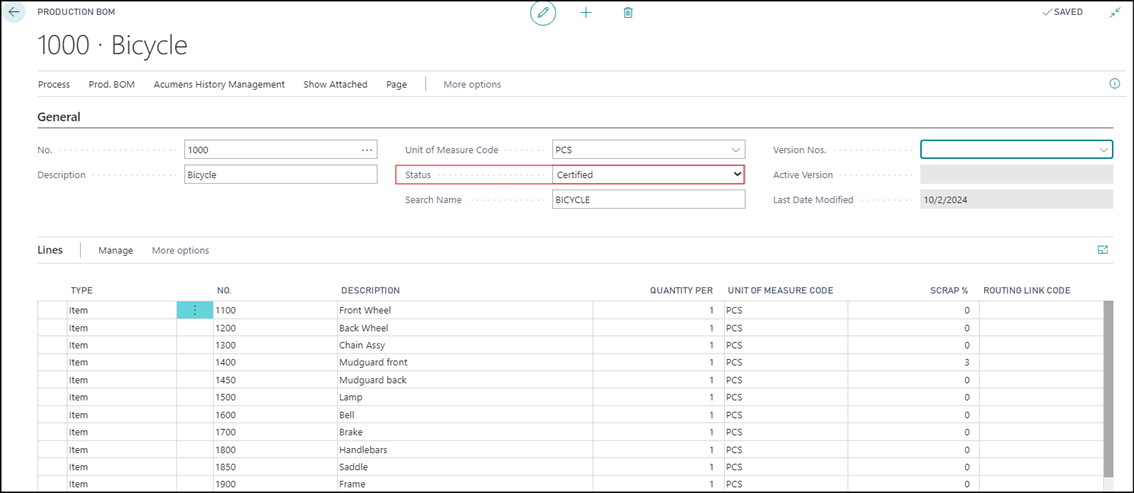

Material costs are costs that are associated with subassemblies and purchased raw material.

Certain Raw material is scrapped while producing a finished item. Set up Scrap% for Materials on either the production BOM or Routing to include in Material Cost.

The material cost of a produced item can be represented in two ways that correspond to the following cost calculation bases.

| Cost Calculation Basis | Material Cost Calculation |

| Single level | Produced item is equal to the total cost of all purchased or subassembly items on that item's production BOM. |

| Rolled-up level or multilevel | Produced item is the sum of the material cost for all subassemblies on that item's BOM and the cost of all purchased items on that item's production BOM. |

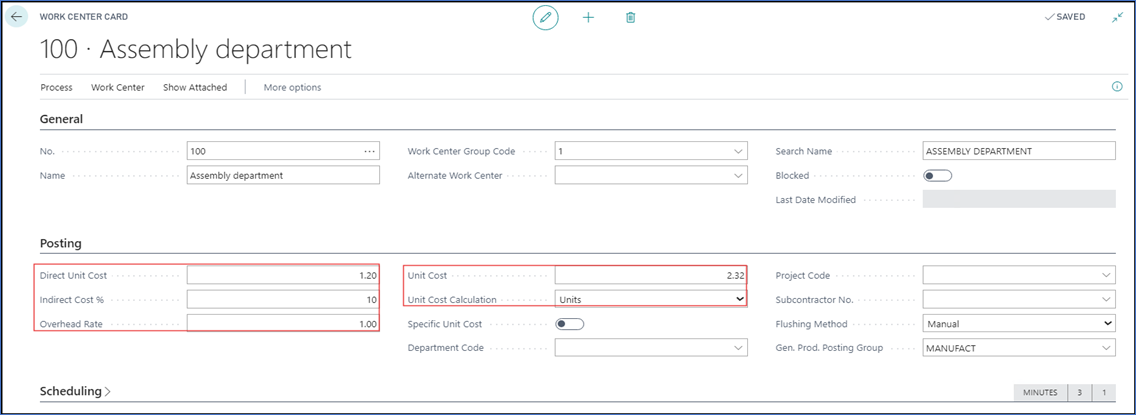

Capacity costs are the costs that are associated with internal labor and machine costs.

Set up these direct, Indirect and Overhead costs for each work or machine center.

Subcontracting costs are the costs that are associated with services that are provided to a company by outside vendors or subcontractors.

Subcontracting is an outsourced capacity. So, its direct and indirect cost are setup on the work center card that represents the subcontracting operation

To define Capacity Cost, define “Direct Unit Cost”, “Indirect Cost %” and “Overhead Rate” on Work Centre Card as shown in below snapshot. This setup is similar for Subcontracting Cost.

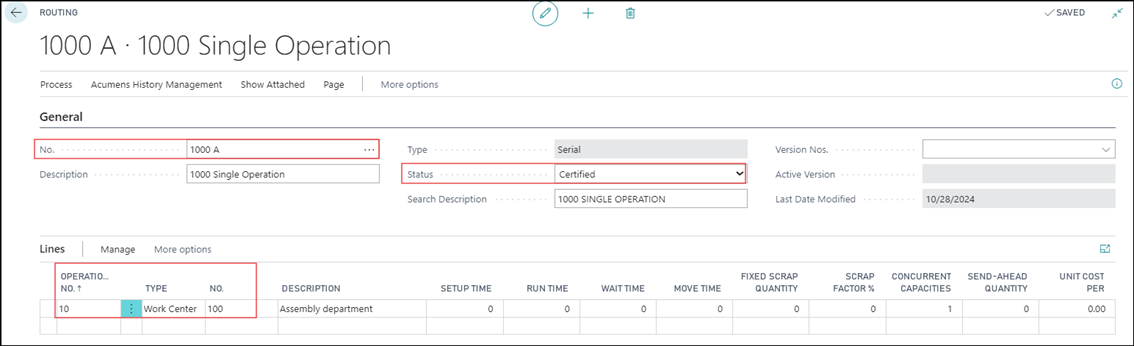

Create Routing using Work Centre created in above setup. Assign this newly created Routing to Item.

To define Material Cost, Create Items, define its Costing Method and Standard Cost/Unit Cost. Create Production BOM, add Component and assign BOM No. on Item Card.

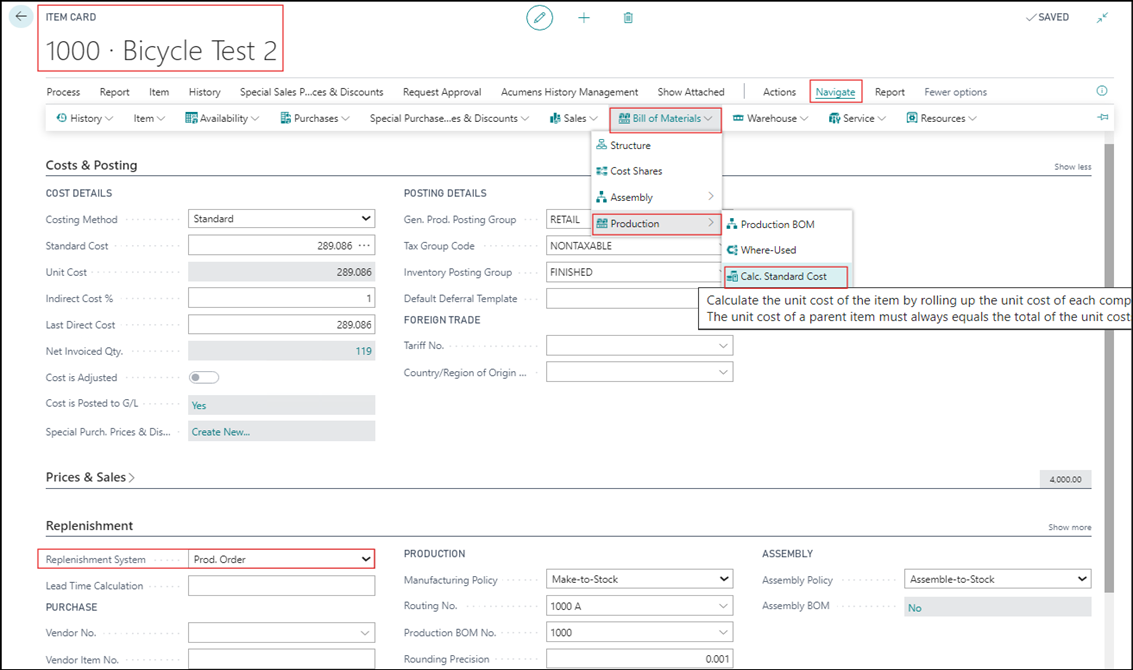

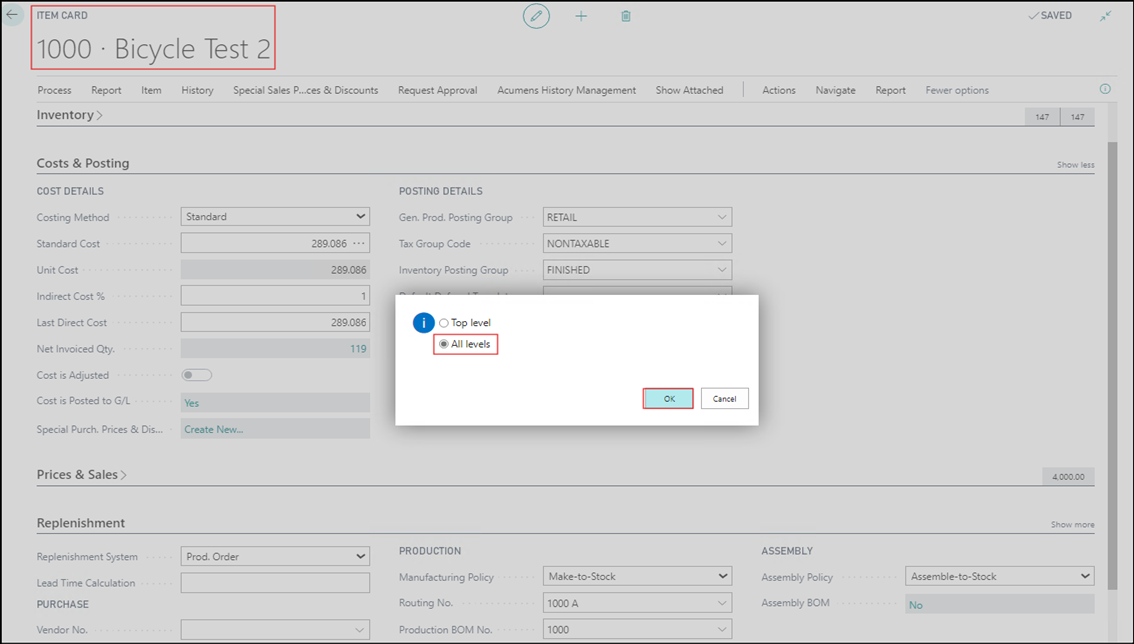

Select the option that you want to consider for calculating Item Standard Cost.

Make sure “Single-Level Material Cost” and “Single-Level Capacity Cost” are calculated and updated. It will be calculated as part of “Calc. Standard Cost” function.

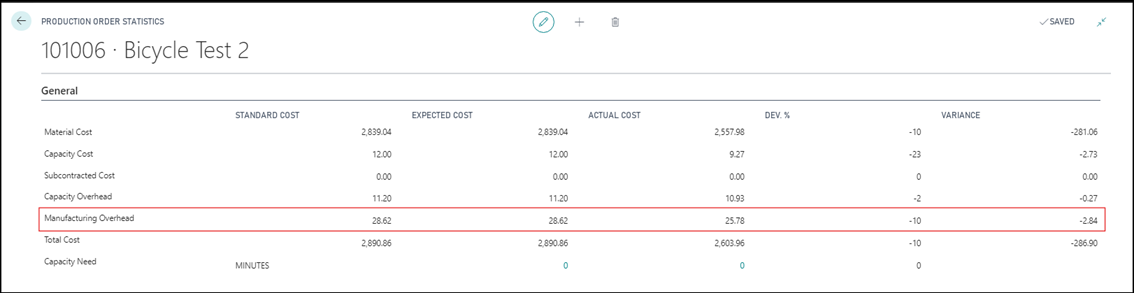

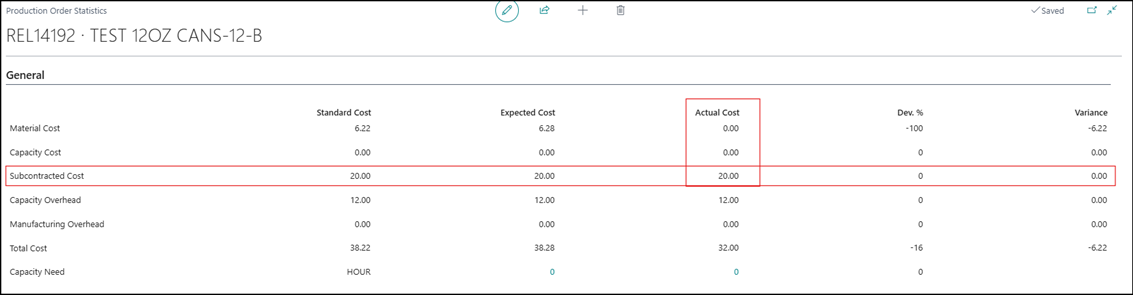

Actual Costs are posted to the production order and can be compared to the production order’s expected cost to see variance. If Item has Costing Method = Standard, then any variances will be posted to the general Ledger when the production order finishes.

The Actual Cost of Production has below components:

Raw Material Costs (Material Consumption) +

Labor Cost – Direct and Overhead (Capacity Cost) +

Subcontracting Costs (Subcontracting Capacity Cost) +

Manufacturing Overhead

= Total Production Order Cost

Production Order Statistics.

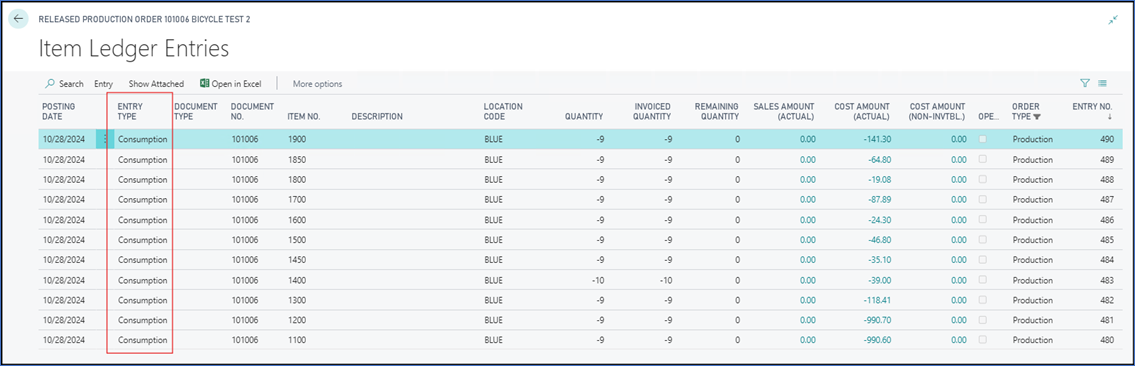

Consumption is posted for Production Order using either Production Journal or Consumption Journal.

Consumption will be posted automatically for Components having Flushing Method = Forward or Backward.

When Consumption posts, below transactions are posted:

Item Ledger Entry:

A consumption Item Ledger Entry is posted to reduce the raw material from Inventory.

G/L Entry:

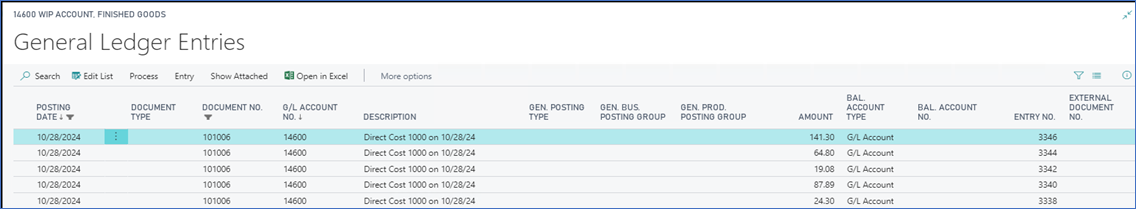

A G/L Entry is posted. G/L Accounts are selected from Item’s Inventory Posting Group Setup. The G/L Entries Posted are:

The WIP And Inventory account is based on the inventory posting group of the item being produced and the location for the consumption.

The inventory accounts are based on the inventory posting group for each of the components and the location for the consumption.

| Debit | WIP Account, Finished Goods | Income Statement |

| Credit | Raw Materials | Balance Sheet |

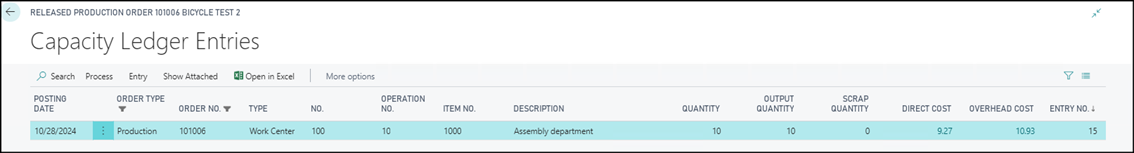

Labor Cost is posted to a production order from either the output or production journal.

When labor is posted, the following transactions occur:

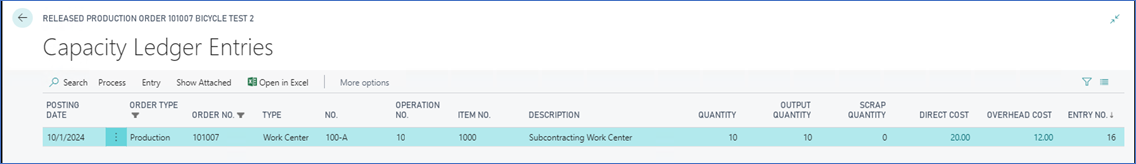

Capacity Ledger Entry:A capacity ledger entry is posted to accumulate labor costs. Labor can be posted as a direct labor cost or an overhead cost.

G/L Entry: G/L Entries are posted below G/L Accounts.

The direct unit cost on the work or machine center is used to calculate Direct Labor Cost. The indirect cost % or overhead rate on the work or machine center is used to calculate Overhead Cost Applied.

The cost of capacity account is according to the direct cost applied account and Overhead accounts is overhead applied account in the general posting setup for the general product posting group defined on the work center and a blank general business posting group.

G/L transaction posts to:

| Debit | WIP Account, Finished Goods | Balance Sheet |

| Credit | Direct Cost Applied, Cap. | Income Statement |

| Credit | Overhead Applied, Cap. | Income Statement |

Manufacturing Overhead is posted to a production order when an output transaction is posted.

When output is posted, the following manufacturing overhead transactions occur:

Production Order Statistics:

The cost is displayed on production order statistics when Output transaction is posted.

G/L Entry:

G/L Entry is posted for production order. The manufacturing overhead is set up on the finished good item card as an Indirect Cost % and/or an Overhead Rate. G/L accounts are selected from the item's inventory posting group setup – It will be direct cost applied account.

The G/L transaction posts to:

| Debit | Inventory | Balance Sheet |

| Credit | Overhead Applied | Income Statement |

Output is posted to a production order from either the output or production journal.

When an output is posted, the following transactions are posted:

Item Ledger Entry:An output item ledger entry is posted to add the finished goods item to inventory.

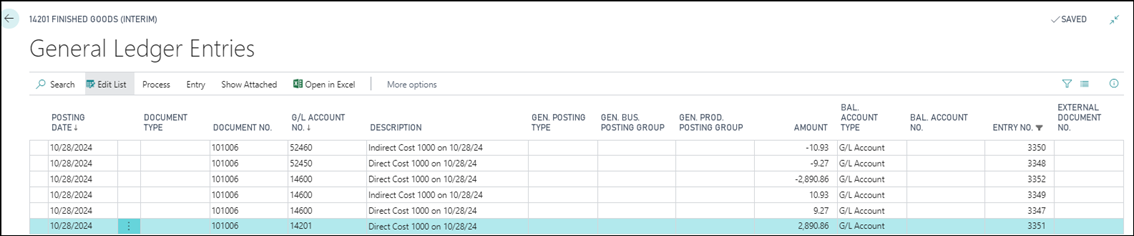

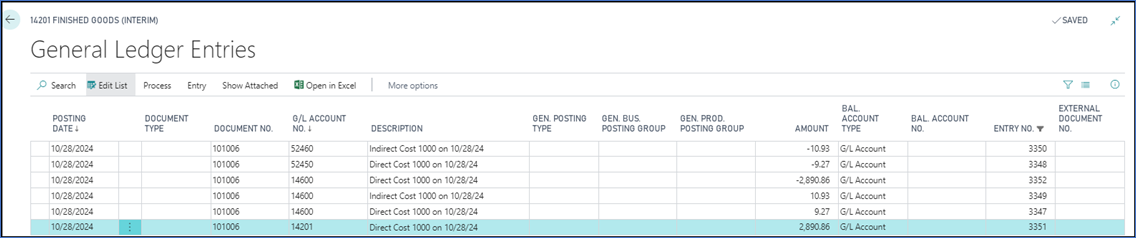

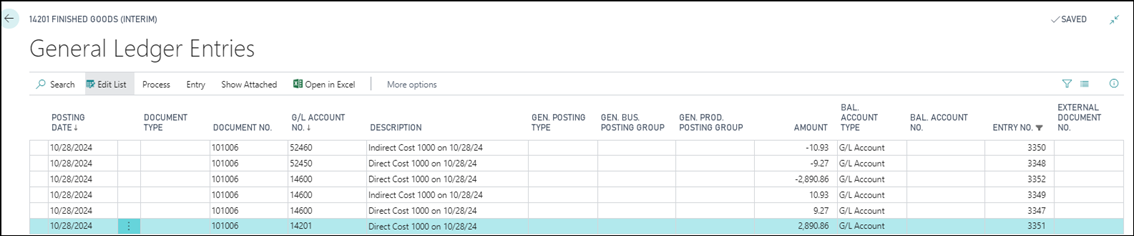

G/L Entry: A G/L entry is posted when Inventory Setup -> Expected Cost Posting is On. The unit cost from the item card is utilized for the expected output cost. G/L accounts are selected from the item's inventory posting group setup.

The G/L transaction posts to:

| Debit | Inventory - Interim | Balance Sheet |

| Credit | WIP Account, Finished Goods | Balance Sheet |

When production output and all cost component transactions are complete, the production order status must change to "Finished" to post "actual" cost for the output transaction using “Change Status” batch process and post variances to the G/L if you use standard cost as the costing method.

The inventory previously posted against the interim account is cleared and moved to the inventory account, the WIP account is also cleared, and any variances are posted against the variance accounts in the P&L.

Item Ledger Entry:

All output item ledger entries for a production order update from expected cost to actual cost.

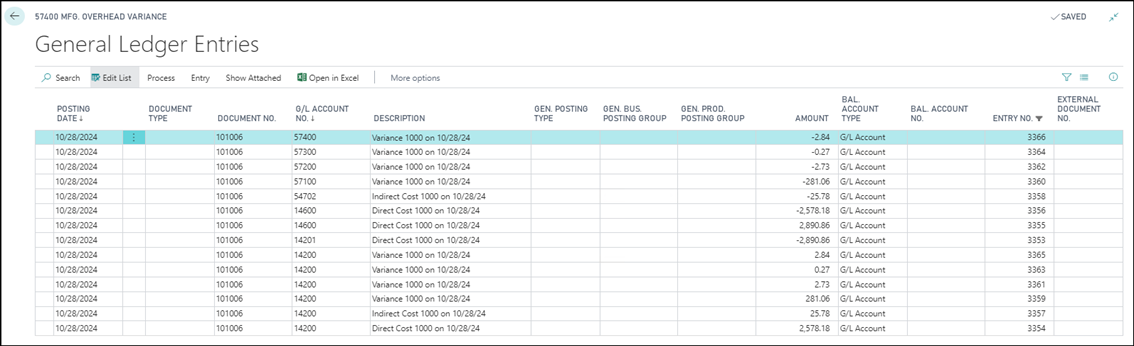

G/L Entry:

A G/L entry is posted only if Expected Cost Posting is turned on. The expected output cost comes from the item card, and the G/L accounts used are selected from the item's inventory posting group setup. Expected Cost is reversed and the G/L transaction posts to:

In the provided scenario, Actual Cost was less than Standard Cost. So, Variance Amount is debited.

| Debit | Inventory, Finished Goods | Balance Sheet |

| Credit | Inventory, Finished Goods (Interim) | Balance Sheet |

| Credit | WIP Account, Finished Goods | Balance Sheet |

| Debit | Overhead Applied, Retail | Income Statement |

| Debit | Material Variance | Income Statement |

| Debit | Capacity Variance | Income Statement |

| Debit | Cap. Overhead Variance | Income Statement |

| Debit | Mfg. Overhead Variance | Income Statement |

Both the inventory account and the different variant accounts (there are five of them) come from the combination of the inventory posting group defined on the item being produced and the location where the output is posted against.

Production Order Statistics.

Subcontracting Worksheet is used to create Subcontracting Purchase Order. When a Subcontracting Purchase Order is invoiced then it is posted to Production Order.

When the purchase order is posted as invoiced, the following transactions occur:

Capacity Ledger Entry:A capacity ledger entry is posted for the total subcontracting cost.

G/L Entry:

A G/L entry is posted. The direct unit cost on the purchase invoice is used to calculate Direct Cost Applied. G/L accounts are selected from the work or machine center's General Prod Posting Group setup and blank General Business Posting Group.

Below G/L Entries are posted for Production Order.

| Debit | WIP Account, Finished Goods | Balance Sheet |

| Credit | Direct Cost Applied | Income Statement |